By John C. Morreale

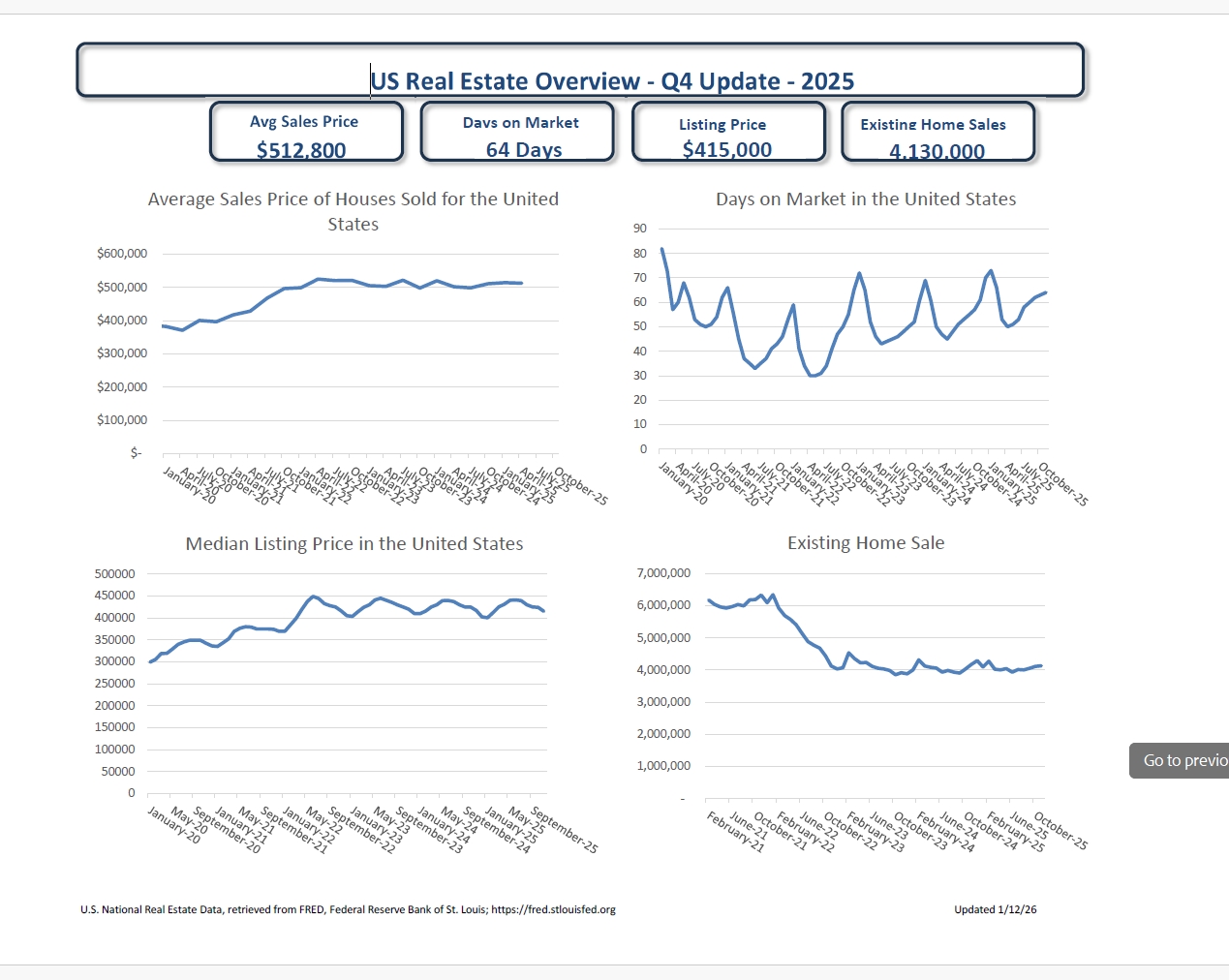

The U.S. real estate market closed out 2025 in a state of relative balance, marked by steady pricing, slower transaction timelines, and a modest rebound in sales activity. Q4 data suggests the market has transitioned away from volatility and into a period of normalization, shaped by cautious buyers, motivated sellers, and continued sensitivity to interest rates.

Average Sales Price Holds Steady

In Q4 2025, the average sales price of homes sold in the United States remained unchanged at $512,800, matching Q3 levels. This price stability reflects a market that has largely absorbed prior appreciation and is now finding equilibrium between supply constraints and softened demand.

Meanwhile, the median listing price declined slightly to $415,000, down from $425,000 in Q3. This adjustment indicates growing pricing realism among sellers as longer marketing times and affordability challenges persist.

Days on Market Extend Further

Market velocity continued to slow in the fourth quarter. The average days on market (DOM) increased to 64 days, up from 62 days in Q3. This ongoing upward trend confirms that buyers are taking more time to evaluate purchases, while sellers face longer holding periods before securing contracts.

Seasonality likely played a role, as year-end holidays traditionally dampen transaction activity, but the broader trend reinforces a more deliberate and less competitive housing environment.

Existing Home Sales Rebound Modestly

Despite slower pace indicators, existing home sales rose to approximately 4.13 million in Q4, an improvement from the 4 million recorded in Q3. This increase suggests pent-up demand from buyers who delayed decisions earlier in the year, possibly encouraged by stabilizing mortgage rates and modest price adjustments.

The uptick in sales indicates that while buyers remain cautious, demand has not disappeared, particularly among needs-based purchasers such as relocations, downsizers, and life-stage movers.

Broader Trends and Market Insights

- Price Stability Signals Market Maturity: Flat average sales prices point to a market that has reached short-term equilibrium rather than one poised for rapid appreciation or correction.

- Buyer Leverage Continues to Improve: Longer days on market and easing listing prices give buyers more negotiating power than in recent years.

- Interest Rates Remain the Wild Card: While rate volatility has eased, borrowing costs remain elevated enough to constrain affordability and limit speculative activity.

Conclusion

The Q4 2025 housing market reflects a clear shift toward stability. Pricing has leveled off, sales activity has modestly recovered, and longer transaction timelines suggest a healthier balance between buyers and sellers. Rather than signaling weakness, these conditions point to a more sustainable foundation for future growth.

As the market enters 2026, attention will turn toward monetary policy and economic momentum. Any meaningful decline in interest rates could unlock additional demand, while continued price discipline may help restore affordability and confidence across the housing sector.