Speakers: John C. Morreale

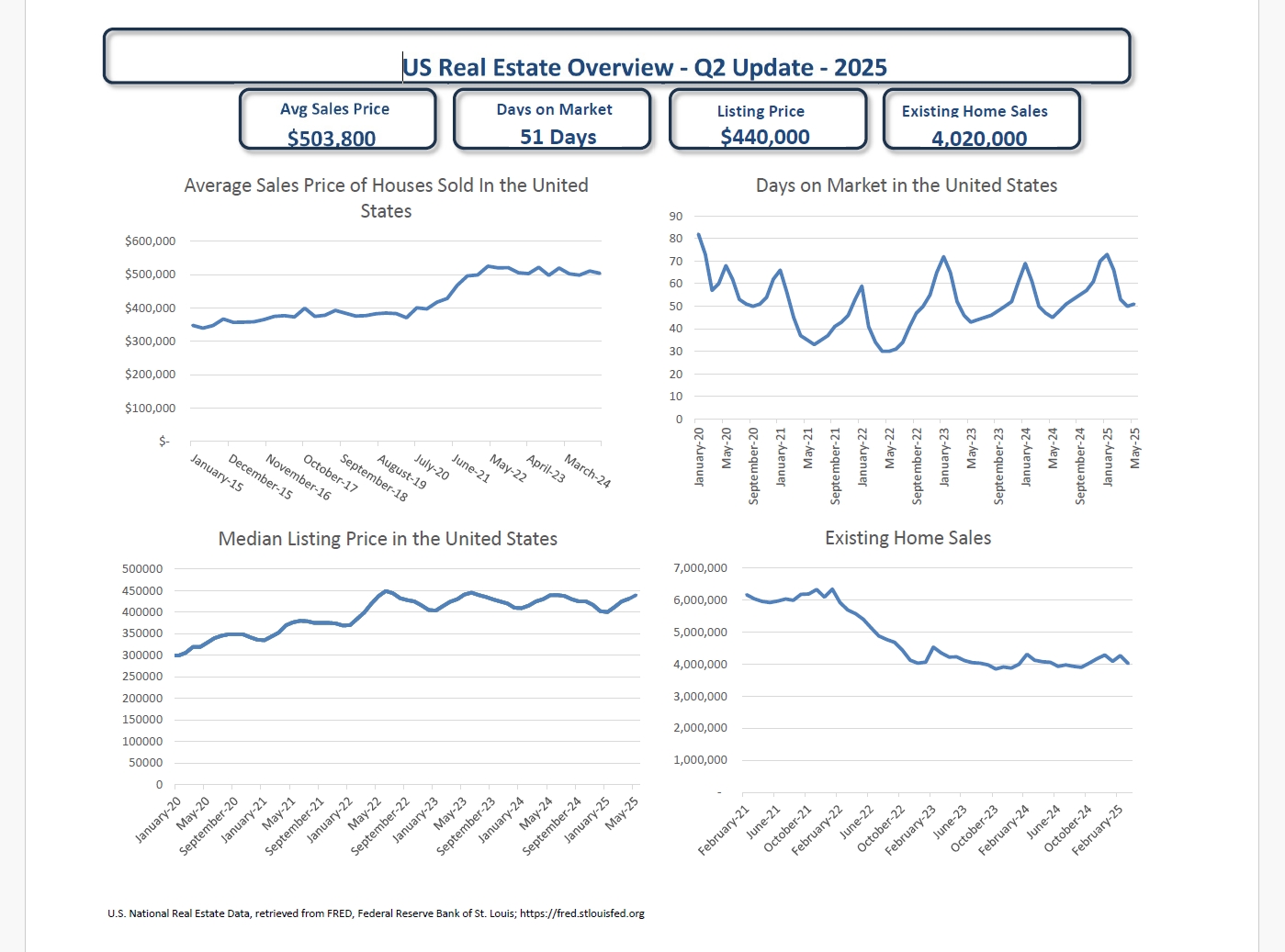

The U.S. real estate market in Q2 2025 presents a mixed picture of softening prices, steady buyer activity, and longer listing periods, signaling a shift from the red-hot market dynamics of the past few years toward a more stabilized, if still uncertain, landscape.

As of Q2 2025, the average sales price of houses sold in the U.S. stands at $503,800. While still historically high, this figure suggests a plateau following the sharp price escalations seen during the pandemic years. The average listing price is slightly lower, at $440,000, which may reflect increased negotiation leverage for buyers or downward pressure from market saturation.

This divergence between listing and sales prices hints at softening demand, as sellers adjust expectations in response to more cautious buyers, higher interest rates, and affordability challenges.

One of the most telling indicators of market cooling is the increase in the average days on market, now sitting at 51 days. This is a notable rise from previous years when homes often sold within weeks—or even days—of listing. Longer days on market suggests buyers are taking more time to evaluate options, and sellers may need to offer more incentives or price reductions to close deals.

Despite rising days on market and elevated prices, existing home sales remain relatively strong, totaling approximately 4.02 million for the quarter. While not a return to pandemic-era highs, this level of activity shows continued movement in the market, likely driven by necessity-based buyers, such as those relocating for work or downsizing in retirement.

Several notable trends are emerging:

- Affordability remains a core issue: The median listing price remains high by historical standards, limiting access for first-time buyers.

- Inventory tight but improving: Although not directly stated in the dashboard, rising days on market and stable sales volumes suggest a gradual loosening of the previously constrained supply.

- Interest rate sensitivity: The Federal Reserve’s monetary policy continues to loom large over the housing market. Mortgage rates have moderated from their 2023 peaks but remain a deterrent for some buyers.

The Q2 2025 real estate market is navigating a complex environment. The days of frantic bidding wars appear to be behind us, for now, with a more balanced market emerging. Buyers have regained some power, while sellers must adjust to a more tempered demand landscape. As economic indicators stabilize and interest rates potentially ease, the second half of 2025 will be crucial in determining whether the market continues its soft landing or faces renewed volatility.