By John C. Morreale

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of WERC.

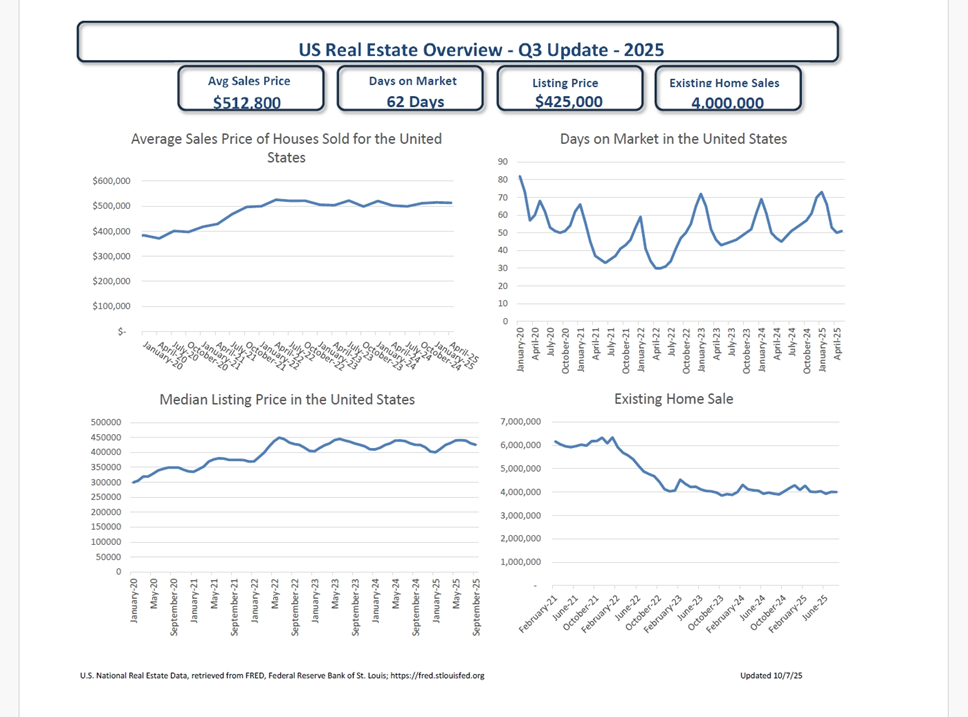

The U.S. real estate market in Q3 2025 shows a subtle but meaningful shift: Prices have inched upward, yet buyer activity continues to cool. The quarter reflects a market in transition. It’s still resilient but increasingly cautious amid elevated borrowing costs and affordability constraints.

Average Sales Price Rises Slightly

In Q3 2025, the average sales price of homes in the United States dipped to $512,800, marking a small decrease from the previous quarter’s $514,200. The median listing price stands at $425,000, reflecting both seasonal adjustments and ongoing competition in mid-tier markets.

This slight price movement suggests that housing supply remains tight enough to maintain pricing pressure—even as demand cools in response to persistent mortgage rate headwinds.

Days on Market Continue to Climb

Homes are taking longer to sell nationwide. The average days on market (DOM) increased to 62 days, up from 51 days in Q2. This trend reinforces the broader narrative of a gradual rebalancing between buyers and sellers. With more listings staying active for extended periods, buyers have gained breathing room to negotiate and compare options before committing.

For sellers, this elongation of the sales cycle underscores the need for realistic pricing and value-driven marketing strategies.

Existing Home Sales Hold Steady but Softer

Existing home sales for the quarter totaled approximately 4 million, a slight dip from 4.02 million in Q2. This modest decline aligns with the seasonal slowdown often seen in late summer and early fall, compounded by affordability challenges and mortgage rate volatility.

Nonetheless, transaction volumes remain stable enough to suggest that the market is not stalling—rather, it’s normalizing after several years of volatility.

Broader Trends and Market Insights

- Affordability Challenges Persist: Wage growth continues to lag behind home price appreciation, keeping ownership out of reach for many first-time buyers.

- Inventory Gradually Easing: Longer days on market point to a mild buildup of unsold inventory, offering buyers more choices than earlier in the year.

- Interest Rates Still a Key Factor: Despite signs of stabilization in inflation, mortgage rates remain near multiyear highs, keeping pressure on affordability and slowing move-up buying.

Conclusion

The Q3 2025 U.S. housing market is marked by resilience amid headwinds. Prices continue to edge higher, supported by limited inventory, even as sales volumes and market velocity ease. The longer selling timelines suggest that the market is gradually cooling but not collapsing.

As the year enters its final quarter, the key question remains whether the Federal Reserve will begin rate cuts in early 2026. A shift in monetary policy could reenergize both buyers and sellers, setting the stage for a more balanced and sustainable housing market in the year ahead.